Kyle Shields

Treasurer

[email protected]

Ingrid Swenson

Business Manager

[email protected]

435.882.6188

Kyle Shields

Treasurer

[email protected]

Ingrid Swenson

Business Manager

[email protected]

435.882.6188

The Stansbury Recreation Service Area and Stansbury Greenbelt Service Area of Tooele County are proposing a tax increase for 2025. Residents will receive a notice that includes estimates of the property tax and the proposed increase. These estimates are based on 2024 data; however, the actual tax amounts and proposed increases may vary from these estimates.

| Current Year Tax Rate | Estimated Tax Next Year | |

| Stansbury Recreation Service Area | 0.0014 | 0.001541 |

| Stansbury Greenbelt Service Area | 0.0014 | 0.001541 |

Property taxes in Stansbury Park fund various public services. In Utah, increasing property tax revenue isn’t just about rising property values; the base revenue remains the same as the previous year. If property values increase while all other factors stay constant, the tax rate would decrease, keeping the total tax amount unchanged. However, the situation is more nuanced. Property taxes are determined by three key factors: Budget, Taxable Value, and Tax Rate. Each of these elements plays a crucial role in the overall calculation.

BUDGET

In Stansbury Park, properties are subject to multiple taxing entities such as the county, Stansbury Park Improvement District, etc. Within each tax area, the budget of these entities largely determines property tax amounts. Each taxing entity is guaranteed the same revenue as the previous year, regardless of changes in property values. This stability means that property tax revenue is a reliable source of funding for many entity budgets.

If a taxing entity, such as the school district, needs to increase its budget compared to the prior year, it must conduct a Truth in Taxation hearing to gather public input. This law mandates public notices and hearings when an entity proposes to raise its property tax revenue above what was collected the previous year. These hearings allow officials to present their reasons for the increase and give residents an opportunity to voice their opinions.

In Utah, all taxing entities must adhere to the Truth in Taxation process each year. While the county collects taxes for these entities, each one operates independently. For instance, Tooele County does not manage the budget for the Stansbury Park Service Agency.

TOTAL TAXABLE VALUE

In Stansbury Park, to determine the total taxable value for the area, you start by summing the assessed value of all properties. Then, you subtract any tax exemptions, such as the residential exemption or properties that are tax-exempt. This total taxable value is crucial as it interacts with the budget to calculate the third component of the property tax equation: the tax rate.

TAX RATE

In Stansbury Park, changes in assessed property values can significantly impact homeowners, but the relationship between assessed value and property taxes isn’t always straightforward. While it might seem logical that property taxes would rise or fall directly with property values, that isn’t always the case.

When overall assessed values change, it can lead to tax shifts, affecting different properties in various ways. For instance, if property values across the county increase by an average of 10%, a property with only a 5% increase could actually see a decrease in its property tax. Conversely, if county values drop by 10% and a property’s value only decreases by 5%, its tax bill could rise.

Every year, assessed values fluctuate differently across various regions and property types, leading to shifts in tax burdens. This means some property owners may experience a reduction in their assessed value while facing an increase in their property tax. It’s important to note that these scenarios are illustrative and may not apply to every individual property.

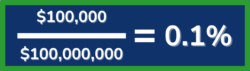

To calculate the tax rate, you can use the following equation:

For example, if a taxing entity has a budget of $100,000 and a taxable value of $100 million, the tax rate would be 0.1%.

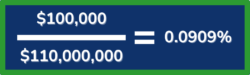

This rate changes annually. If the budget stays the same but the assessed values change, the tax rate will adjust inversely to the assessed value. So, if the taxable value rises to $110 million, the tax rate would decrease to approximately 0.0909%.

| Tax Year | Tax Rate | Budget Tax Revenue | Actual Revenue |

|---|---|---|---|

| 2013 | 0.0014 | $882,873 | |

| 2014 | 0.001256 | $814,481 | |

| 2015 | 0.001206 | $842,390 | |

| 2016 | 0.001154 | $868,752 | |

| 2017 | 0.00105 | $889,168 | |

| 2018 | 0.001013 | $930,732 | |

| 2019 | 0.001054 | $1,153,850 | |

| 2020 | 0.001007 | $1,153,850 | $1,510,855 |

| 2021 | 0.000939 | $1,153,851 | $1,429,705 |

| 2022 | 0.000692 | $1,516,203 | $1,504,366 |

| 2023 | 0.000691 | $1,537,508 | $82,724 |

| 2024 | 0.0014 | $1,537,508 |

2025 TAX RATE INCREASE PROPOSAL

QUESTIONS & ANSWERS

Why do you need a boost in the operating budget?

Why are there two tax raises listed on my mailer? Will I have two tax increases?

What is the relationship between the Greenbelt Service District, The Recreation Service District, and the Service Agency?

Why is my increase, i.e., $200/month?

Aren’t new homes automatically accounted for in the taxation process?

Why don’t you gradually raise taxes over 4-5 years?

Why can’t we properly budget so we don’t have to pay more taxes?

Why don’t you sell properties (greenbelts)?